With the surge in demand for AI chips, Nvidia has achieved a record-breaking rally in the stock market, surpassing Apple to become the world’s most valuable company.

According to LSEG data, Nvidia’s market value briefly reached $3.53 trillion, slightly surpassing Apple’s valuation at $3.52 trillion.

Nvidia, Microsoft, and Apple Neck-and-Neck

In June, Nvidia held the title of the world’s most valuable company for a short period before being overtaken by Microsoft (MSFT) and Apple. The market valuations of this tech trio have been closely matched for several months now.

Nvidia’s Stock Continues to Climb

Nvidia produces chips used to train foundational models, such as OpenAI’s GPT-4. Following a $6.6 billion funding announcement by OpenAI, the company behind ChatGPT, Nvidia’s stock has surged nearly 18% so far in October amid a series of gains.

AI Tailwind Boosts Nvidia

AJ Bell’s investment director Russ Mould commented, “With more companies adopting AI in daily operations, demand for Nvidia chips remains strong. Nvidia is certainly well-positioned, and unless there’s a major economic downturn in the U.S., it seems likely that companies will continue investing heavily in AI capabilities, creating a strong tailwind for Nvidia.”

Nvidia’s shares hit a record high on Tuesday, boosted by a robust earnings report from TSMC (TSM), the world’s largest contract chipmaker, reflecting increased demand for AI chips.

A Crucial Test Ahead for the Chip Giant in November

Nvidia’s next major test will be its third-quarter results in November. According to data compiled by LSEG, Nvidia has forecast $32.5 billion in revenue for the third quarter, slightly below the current analyst consensus of $32.9 billion as of August.

Recent Rally Raises Expectations

In a note dated October 10, Morgan Stanley analyst Joseph Moore stated that he remains optimistic about Nvidia’s long-term outlook but noted that the recent rally has “raised the bar slightly” for its earnings performance.

A 12-Month Full Reservation for Chip Production

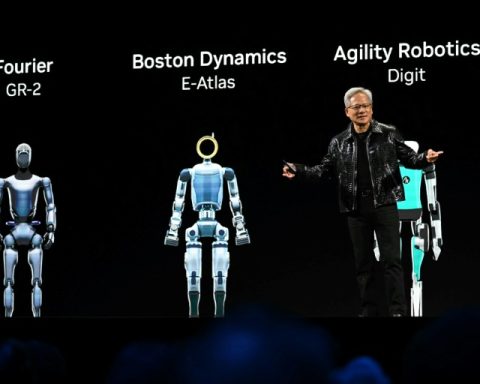

After meeting with Nvidia CEO Jensen Huang, Moore reported that production capacity for the next-generation Blackwell chips “appears very strong” and is fully booked for the next 12 months.